Why Empathy in Insurance Is Essential for Increased Customer Retention

As an insurance provider, stepping beyond the conventional realm of transactional interactions with your clients is a solid first step in paving the way for a culture of exceptional customer service. The insurance customer experience trends of today emphasize a personalized approach, which is the cornerstone for insurance customer retention.

It's no longer about being just a policy provider; it's about empathizing with your clients, understanding their needs, and crafting a service experience that resonates with them on a human level. Integrating empathy in insurance practices is the way forward, creating authentic human connections and meeting your customers where they want to find you.

What Are the Shortcomings of Traditional Insurance Agent Customer Service?

A thorough customer communication strategy addresses clients' inquiries and alleviates any concerns regarding policy coverage and benefits. However, failing to provide such services leaves clients upset, annoyed, and often seeking answers elsewhere.

Here are some shortcomings of traditional customer-agent interaction:

Fostering Empathy: The role of empathy in insurance is crucial, especially when clients reach out following distressing incidents like theft or accidents. Customer service agents are essentially the face of your company, interacting with current and prospective clients. The perception of your brand hinges on how well these agents treat people, transcending the mere transactional discussions about prices and coverage.

Personalizing Services: Policyholders tend to feel a stronger bond with their insurance provider when the insurance agent customer service is tailored to their needs, displaying a human touch. This rapport is precious as customers appreciate being seen and treated as individuals, not just policy numbers.

Engaging Communication: Many customers find comfort in discussing their options over a phone call rather than through impersonal emails or text messages. The personal interaction during a phone call can significantly influence a customer's decision to either engage with or remain loyal to a particular insurance provider. This highlights the importance of human interaction in enhancing the insurance customer experience and ensuring satisfaction.

How Can a Customer Communication Strategy Keep Your Clients Happy?

Moving beyond just selling insurance to truly connecting with clients opens up a new way of doing business that's all about trust and understanding. This isn't just good for customers; it's a smart move for insurance providers aiming to stand out in a crowded market.

Below, we dive into why forming real relationships with clients, showing empathy, and earning trust can make a big difference in keeping customers satisfied and loyal over time. Each point outlines the benefits of this people-first approach for insurance providers.

Authentic Relationships: Establishing genuine connections goes beyond merely providing policy coverage; it encompasses delivering a unique, irreplaceable level of care. By displaying genuine concern and making customers feel valued rather than just another name on a client list, insurance providers can cultivate a more loyal clientele.

Emergence of Empathy: The role of empathy in insurance cannot be overstated. When insurance providers prioritize the needs and concerns of their customers, they not only encourage immediate transactions but also foster long-term loyalty, creating a mutually beneficial relationship.

Trust As a Backbone: Building trust with your clients alleviates any inherent skepticism toward insurance agents, thus promoting client retention. Moreover, the cycle of returning clientele translates to renewal commissions, showcasing a financially advantageous outcome when a trust-based relationship is established.

Correlation of Trust and Retention: Research highlights a direct correlation between trust and customer retention within the insurance sector. A deficit in trust could push customers toward contemplating a change in their insurance plans, underscoring the necessity of trust in fostering lasting client relationships.

Implications of Service Quality: The quality of service significantly impacts customer retention and loyalty. Extensive customer service research found that in 2020 alone, 40% of customers stopped doing business with a company due to poor customer service. This means that nearly every other customer you interact with has the potential to switch insurance providers if they are not satisfied with their experience.

In 2020 alone, 40% of customers stopped doing business with a company due to poor customer service.

Cost Efficiency in Nurturing Relationships: The cost efficiency of nurturing existing relationships over forging new ones is evident, as improving customer retention by just 5% can boost profits by over 25%.

Improving customer retention by just 5% can boost profits by over 25%.

Customer Treatment Impact: Customer treatment considerably influences buying decisions. McKinsey & Company states that 70% of buying experiences are shaped by how customers feel they are being treated. Additionally, Salesforce research reveals that a notable 62% of customers are likely to share negative experiences, thus emphasizing the critical need for insurance providers to pivot toward a more empathetic, customer-oriented approach to bolster a robust insurance customer retention strategy.

3 Ways to Infuse Empathy in Insurance and Engage With Clients Effectively

Insurance companies play a pivotal role in safeguarding individuals' and communities' financial health. Engaging with clients and prospects in a meaningful way is not just about creating better business outcomes but also about fostering trust and understanding. Here are three strategies to get started on the right foot.

1. Offer local learning seminars.

Insurance providers can significantly benefit from immersing themselves in the local community. By hosting educational seminars, they can create a platform for interaction and trust-building with clients and prospects. This local presence can translate to a better customer experience as it fosters a sense of community and understanding between the insurance company and its clientele.

2. Go beyond transactional interactions.

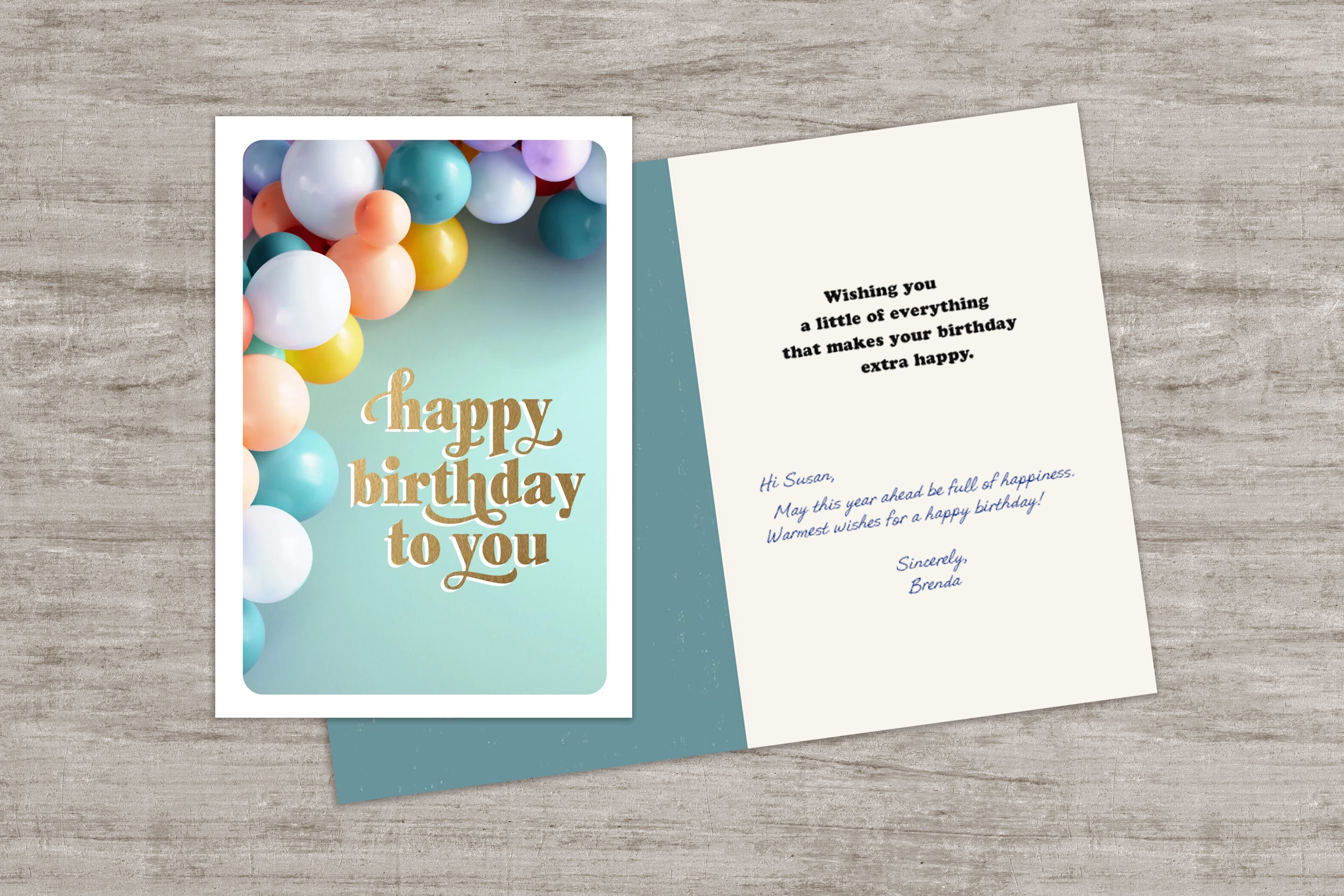

A shift from purely transactional interactions toward more engaging and personalized experiences is among the evolving insurance customer experience trends. For instance, insurance providers can utilize direct mail services to send personalized cards to clients on special occasions such as birthdays or holidays. This gesture, albeit small, can make clients feel valued and appreciated, which is crucial for insurance customer retention.

3. Innovate new engagement strategies.

In an effort to establish authentic relationships, consider hosting community events, either in-person or virtually. These events provide an excellent opportunity for insurance agents to interact with clients and prospects. For example, events centered around Medicaid and health insurance guidance help in crafting personalized insurance packages tailored to meet local residents' needs. This strategy not only facilitates an insurance agent-customer service rapport but also significantly aids in customer communication and understanding, contributing to increased customer loyalty and retention.

Are You Ready to Start Building Lasting Connections?

Adopting a community-focused approach, moving beyond just sales to meaningful engagement, and embracing creative strategies are key steps for insurance providers aiming to build trust and loyalty with their clients. By showing empathy in insurance dealings and having a strong customer communication strategy, organizations can keep their existing clients while setting a new standard in customer service.

Hallmark Cards can also significantly aid in creating personal, emotional bonds with your customers. By moving away from traditional transactional interactions, insurance firms can show their clients that they are valued, especially during life's celebratory moments. Sending a personalized and heartfelt card can transform a simple interaction into a memorable experience, fostering a lasting connection.

Through such gestures, insurance companies not only meet current demands but create a landscape of trust and mutual understanding, driving the industry toward a more empathetic and community-oriented horizon.

For more information or assistance, please don’t hesitate to contact us here. We’re always happy to help.

In this Article

-

What Are the Shortcomings of Traditional Insurance Agent Customer Service?

-

How Can a Customer Communication Strategy Keep Your Clients Happy?

-

3 Ways to Infuse Empathy in Insurance and Engage With Clients Effectively

-

Are You Ready to Start Building Lasting Connections?

Similar Articles